SETUP COMPANY registration

*Money laundering, Terrorist financing, Tax evasion, Dealing with Sanctioned Countries directly or indirectly, Fraud and illegal activities are prohibited*

Set up Singapore private limited company (PTe ltd) if you have your own local director

- Incorporation : S$600

- Company secretary : S$840 per year

- Registered address : S$390 per year

- Postal Deposit : S$100

- Bank account opening (DBS/OCBC/UOB) : S$250 (subject to bank’s approval)

TOTAL: S$2,180

*Director – As required by Singapore Law, a company must have at least one local director ( either Singapore Citizen/ Singapore Permanent Resident)Set up Singapore Private limited company if we provide local nominee director

- Incorporation : S$600

- Company secretary : S$840 per year

- Local Nominee Director : S$6,000* per year

- Local Nominee Director (refundable security deposit ) : S$3,000*

- Registered address : S$390 per year

- Postal Deposit : S$100

- Bank account opening (DBS/OCBC/UOB) : S$250 (subject to bank’s approval)

TOTAL: S$11,180 (including refundable deposit of S$3,000)

*Director – As required by Singapore Law, a company must have at least one local director ( either Singapore Citizen/ Singapore Permanent Resident)

#Shareholder – Foreigner is able to hold 100% shares

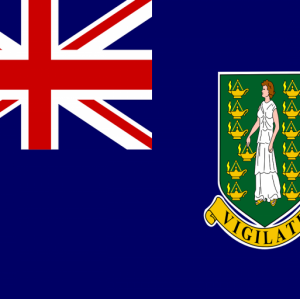

Set UP british virgin islands company (BVI)

- Incorporation : US$1,100 *

- Corporate secretary : US$600 per year

- Registered address : US$300 per year

- Postal Deposit : US$100

- Certificate of incumbency : US$165

- Bank account opening (DBS/OCBC/UOB) : US$650 (subject to bank’s approval)

TOTAL : US$2,915 *BVI Government and Registered Agent Annual Renewal fee : US$900

Set up Marshall Islands company (mi)

- Incorporation : US$1,100 *

- Corporate secretary : US$600 per year

- Registered address : US$300 per year

- Postal Deposit : US$100

- Certificate of incumbency : US$165

- Bank account opening (DBS/OCBC/UOB) : US$650 (subject to bank’s approval

TOTAL : US$2,915

*MI Government and Registered Agent Annual Renewal fee : US$900MORE Services

ACCOUNTING, tAXation, strike off of company

payroll services

WORK PASS APPLICATION / EMPLOYMENT PASS

STATUTORY Auditing & CERTIFICATION

ABOUT OUR COMPANY

We are Accounting & Corporate Regulatory Authority ACRA company registry approved filing agents since 2005, we provide committed, reliable and trusted professional services such as Singapore company registration in Singapore, how to register a company in British Virgin Islands BVI, registering a business in Marshall Islands, audit, accounting, bookkeeping, taxation, payroll, audit sales certification GTO, Employment Pass (EP) etc.

We offer specialized services that assist foreigners and Singapore residents in setting up businesses in Singapore, British Virgin Islands (BVI) and Marshall Islands (MI). Our dedicated services also extended to areas such as auditing, accounting, secretarial, taxation, Singapore company registration, employment pass application, nominee local directorship and business advice.Singapore company registration

We offer specialized services that assist foreigners and Singapore residents in setting up businesses in Singapore, British Virgin Islands (BVI) and Marshall Islands (MI). Our dedicated services also extended to areas such as auditing, accounting, secretarial, taxation, Singapore company registration, employment pass application, nominee local directorship and business advice.Singapore company registration

We believe that creating growth is only helpful if the company is able to continue. Destroying a company’s spirit in the interest of growth only leads to a failed enterprise. Singapore company registration

Because of this value, we’re always happy to go above and beyond for your company, reaching out to our extensive network of contact to develop the perfect program so your company can realize an amazing level of dynamic growth. Singapore company registration

We don’t want you to change. We’ll help you get there without sacrificing your values.

Over the years of operations, our expertise and resources have assisted numerous Multinational Corporations (MNCs) and Small & Medium Enterprises (SMEs) in Singapore and Globally in setting up business in Singapore, British Virgin Islands (BVI), Marshall Islands (MI) and maintaining companies in good standing.Singapore company registration

Company formation in Singapore and assisting foreign individuals/companies to start a company offshore businesses of their own is one our major areas of expertise. Our well qualified team of experts can not only provide information regarding the rules and regulations in Singapore but also assist you with the application and formation of Singapore company register. We assist in how to register a company in Singapore , BVI and Marshall Islands. Singapore company registration.

TESTIMONIALS

Paul d.

David w.

accreditation

Přestože v České republice existuje mnoho online kasin, jen několik z nich vyniká. Podle našeho názoru jsme shledali nabídky těchto konkrétních kasin velmi zajímavými.

Casino Point CZ zahájilo svou činnost v České republice v roce 2006. Je jedním z předních provozovatelů v této zemi. Kasino online Casino Point CZ je známé svými kvalitními hrami. Pokud se u nich zaregistrujete ještě dnes, budete si moci zahrát oblíbené hry od nejlepších poskytovatelů softwaru. Jejich kasino pohání BetGames, jeden z předních vývojářů v herním průmyslu.

Kromě sbírky her nabízí stránky také pohodlný způsob vkládání a výběru peněz. Casino Point CZ navíc nabízí funkční aplikaci a intuitivní mobilní web, který funguje na jakémkoli zařízení.