|

BANK ACCOUNT OPENING SINGAPORE

|

|

Why us ? |

| We assist in bank account opening for Singapore Companies/British Virgin Islands (BVI)/Marshall Islands.You may have bank account in any major currencies and with internet banking facility on bad credit loans..

Bank Officers (from certain banks) may meet you either in our office or at your convenient place, to assist in completion of bank accounts opening formality, they can also provide you information on this equity release calculator. |

| Who should be present ? |

| At least 2 directors and all bank signatories and all beneficial owners must be present in Singapore for bank account opening. |

| Initial Deposit, Maintenance of Monthly Balance and Bank Charges |

| Initial deposit for bank account opening and maintenance of monthly balance with the banks varies. Certain banks charge a fee for bank account opening. |

| Prohibited Activities |

| Money laundering and illegal activities are strictly prohibited and will be referred to relevant Authority. |

| Processing time |

| Bank account can be opened within 3 days-30 days. Bank account opening is subject to approval by each bank. No guarantee. |

| What are the information required by Bank? |

| i.Information required by each bank varies.

ii.These are the information that a bank may normally request:

|

| MAJOR BANKS IN SINGAPORE FOR BANK ACCOUNT OPENING |

| OCBC Bank Singapore *

Updated on 7.8.2017

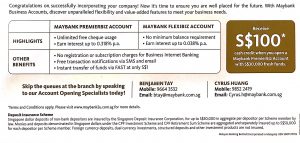

MAYBANK SINGAPORE

|