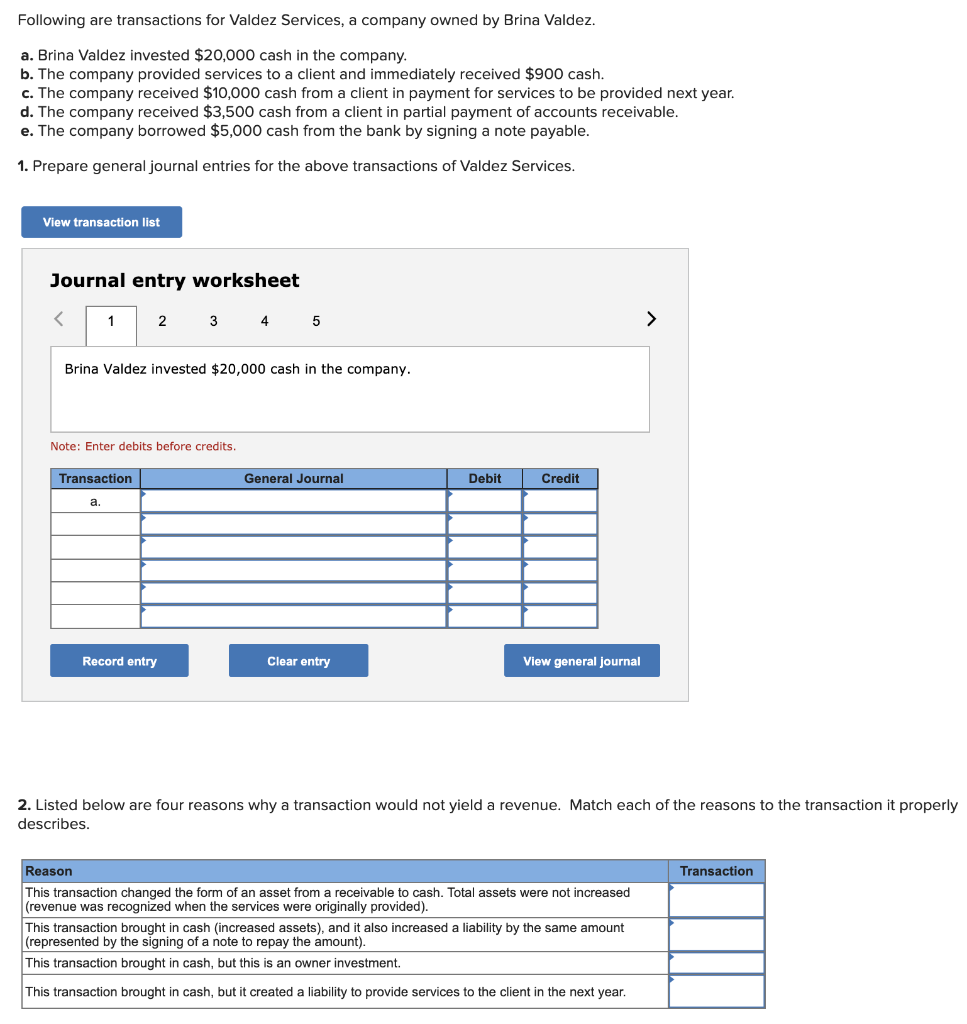

Possibly you ordered an effective reily has actually merely outgrown your house therefore you would like a supplementary room. No matter what reasoning, there are certain different methods to fund your home renovation or home create.

What is actually right for you depends upon your preferences, finances, budget together with the amount of your renovations. Here is a summary of a number of the a means to financing a renovation that you may wish to imagine:

With your discounts

If you have coupons to dip toward to invest in the recovery, this may help save you paying interest toward a loan. In case the discounts come into a counterbalance membership linked to your own home loan, think examining just how your own mortgage payments is generally influenced before you withdraw the income to invest in the renovation.

If you are expenses more minimal amount on the mortgage and you’ve got a great redraw business, you may be in a position to availableness a lot more repayments you made disclaimer . There are no costs in order to redraw out-of an enthusiastic ANZ home loan and with ease availability the money via ANZ Websites Financial and other smoother suggests. Withdrawing your extra finance really does but not indicate you’re going to be using so much more focus.

Making use of the collateral you gathered on the newest household

If you’ve had your residence for a time, you have security in your home. House equity ‘s the difference in the worth of your home while the matter you may have left to expend on the house mortgage. You are able to use that it security to help you borrow the newest currency that you should pay money for your residence renovation.

A home loan pro can help you determine how much cash you can borrow and how far ‘usable equity’ your ount you might be capable obtain are calculated during the that loan so you can Worthy of Proportion (LVR) of 80% or less (we.elizabeth. 80% of the difference in the fresh new bank’s testing of the market worth of your home along with your latest mortgage balance).

Something to bear in mind would be the fact a rise in your own financial ount interesting you have to pay on your own installment loans, Columbus mortgage – so you might wish to estimate your instalments otherwise keep in touch with an enthusiastic ANZ financial pro to find out what they have a tendency to become.

- Expanding otherwise topping’ your current mortgage, that allows one contain the money your acquire consolidated in the main one lay

- An additional loan that is a different loan that delivers your the choice to arrange your interest and you may mortgage label in another way than your mortgage

A home loan professional can be cam you from the different ways you happen to be capable construction the loan and help your determine what the extra repayments might possibly be.

Design financing to own a primary house repair

While you are deciding to knock down and begin once more, or you’re carrying out biggest home improvements, a homes financing could be a remedy. With a housing loan, the money is released given that a few advances payments’ since your builder closes for each stage of one’s create. Once the payments manufactured, might draw down’ on your mortgage and begin paying interest only to the the total amount you really have put. By starting money within the staged payments, in place of in one single lump sum payment upfront, you’ll only pay attract to your currency because you utilize it.

Personal bank loan to own lesser home improvements

If you’re considering a small renovation, you would like to imagine trying to get a personal loan. They may be a convenient choice, but be careful that frequently the speed is actually large to possess a personal loan compared to home loan possibilities.